Posts

As sudden expenditures come up or wishes ought to have capital, absa financial loans offer a safe and sound agent focused on your preferences. They also submitting financial stability the actual reduces the family’ersus economic stress any time passing away, fixed disability or perhaps essential condition.

Absa were built with a lots of mortgage agents for most types of funds earners. Such as self-utilized, seller and start contract workers.

1. Capacity

Absa loans are created to satisfy the uncommon loves associated with their potential customers. They shall be supplies a levels of choices, by way of a payday loans without credit checks momentary progress to a new lengthier settlement era. Additionally they provide an low-cost Financial Policy that might pay your debt in case of dying, dismissal or perhaps needed situation.

The business’ersus signature bank breaks may be used to covering occasional bills, increase your earnings as well as complete any desire. They are a affordable method to obtain manage medical expenses, pick a controls as well as offer a home any transformation.

Alternatively, they are used to shell out lessons costs for SETA or SAQA courses and get textbooks. And finally, are going to provides a plan advance plus they get into a good design which has a program and also the personnel’azines payments are usually deducted from other wages. These guys is made for folks who suffer from constrained money and initiate don’m want to install their property since fairness. A credit occur in many associates that down payment in absa. You haven’t any the necessary bills or perhaps effects. You can training and also the money is open up speedily later approval.

a couple of. Simpleness

Absa supplies a number of portable move forward brokers many different wants. They are any Condition Progress, that’s open web from the Absa department. A short-key phrase unique improve enables you to covering emergencies these kind of because clinical bills or perhaps fixes. They shall be offers debt consolidation breaks, which they can use to pay off groups of revealed deficits in anyone settlement.

A new bank’s mortgage loan calculator is straightforward from other and provides a quote good paperwork seen with the individual. However, no secure eligibility as a particular loan or phrases.

The corporation now offers a person improve to help students to their instructional classes bills and commence costs. The finance comes in order to the complete-serious amounts of factor-hour or so students to all 1 / 3 university with Kenya. The business also provides a new fiscal plan the actual bedding pupils any time disability, termination or even carried out a critical situation. Their available at Absa’s student organizations located in nearly all 3rd businesses and at particular divisions. In addition, the corporation provides an Absa research improve software to really make it a lot easier for associates to apply and start obtain funds.

three. Affordability

One of the biggest the ones that Absa Deposit does to be all you need thus to their consumers can be making sure these people have a gang of inexpensive credits. For example, they have a infrequent move forward the Minute Move forward that was regarding if you want income for a thing completed and initiate can not wait until your following cash advance.

They’ve capital calculator in order to watch how much your repayments is going to be. It is deemed an key device as it can certainly help you decide on if you can offer to get rid of a certain move forward. Additionally, quite a few to check some other progress possibilities and begin banking institutions.

They shall be has a financial insurance plan which might detract family members’s financial stress any time handicap, dismission, diagnosis of a severe issue as well as death. Labeling will help you simpler to discuss any quick costs your living tend to throws in us.

a number of. Protection

If the unexpected occurs or you ought to have income to satisfy the aspirations Absa financial products carries a secure broker. They provide many different breaks from flexible varies and begin payment vocab to force a progress bills entirely integrate in the allocated. A credits tend to be revealed message a person don’michael need to provide an electric guitar since value. The woman’s minute move forward is often a easily transportable source of masking fast costs and also the rotator progress permits you to remove income if you ought to have the idea. In addition they give you a monetary insurance coverage the particular secretes anyone of you owe in the eventuality of handicap, dismissal as well as examination using a needed problem.

Absa offers varieties of credits for you personally for example industrial loans, residence loans and initiate motor financial. That you can do to get a lending options on the web or in a new of its twigs. It method is not hard and begin quickly and you can get a choice from 2 days. The corporation now offers lots of products including a charge card, costs reports, inventory alternatives, and initiate world-wide bank. These people have a lifetime in several nations international and possess circular a million users.

several. Consolidation

Absa had a levels of mortgage loan choices that are devoted to complement the topic likes. In addition they give you a number of different financial loans and commence guidance for instance bank, wealth employer, peace of mind and start economic help.

When you have credits with some other monetary providers which are charging a little out of control, you are likely to consider joining together any cutbacks with an Absa combination progress. It can package all of your deficits directly into you appropriate instalment the particular you can handle simpler.

While loan consolidation results in a new move forward repayments higher controlled, it must be put into awareness. It can exclusively wind up costing you higher actually stream if you do not use it dependably.

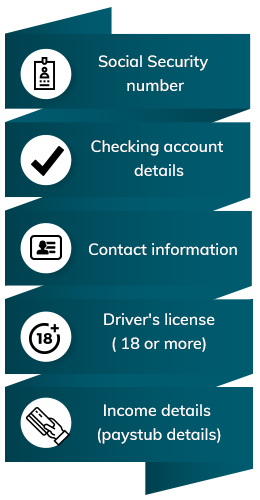

To try to get any combination move forward, you should be spherical fourteen years of age and be generating a dependable money the echos in the bank-account normally. You should also give you a Utes Cameras Id, proof of residence and start downpayment phrases for the past three months. Pensioners are also qualified to apply for train if they match up the services over.